1st QUARTER 2014

41

Which CFOs have appeared in CFO Studio on-camera interviews?

Find out at

get overloaded with information but misses

critical items that would be pointed out in a

timely analysis.

Supporting repetitive FP&A tasks using

an efficient setup would alleviate this issue.

However, despite significant investments

into enterprise resource planning (ERP)

systems, their benefit for FP&A is gener-

ally limited. Much of the data needed for

the FP&A function comes from non-ERP

systems.

A great basis for much of the FP&A data

could be the consolidation tool that many

large organizations use to merge their

financials, such as Hyperion, Cognos, or

SAP BPC. While older implementations of a

consolidation tool generally focused on data

necessary for corporate reporting, recent

implementations include more functionality

(drill-down/commenting) and the capabil-

ity to add details, including non-financial

information.

Despite the diversity and complexity of the

organization, such consolidation tools will

easily solve most of the data requirements

for FP&A (think 80/20 rule) due to a higher

degree of automation. This would allow

FP&A staff to spend more time on analysis

and supporting the business.

The primary goal in setting up these sys-

tems is to focus on creating commonalities so

as to replicate them in the system, and cover

exceptions (e.g. specific business require-

ments) outside the system or with flexible

worksheets that link to data contained in the

system.

PROCESSES

M

any organizations combine FP&A and

accounting under the same manage-

ment. However, these functions are different

in nature, and although there is a link be-

tween them, their target audience and focus

is different. Accountants focus on accurately

closing the books and ensuring compli-

ance with tax and other regulations. FP&A

focuses on providing the business with

timely information to make good business

decisions.

Despite being separate functions, FP&A

can piggyback on accounting processes and

share the same systems. From a process

standpoint, FP&A does not need to wait until

the books are closed. Working in parallel will

result in quicker and more timely analysis.

The consistency mentioned above in set-

ting up systems is also key in the setting-up

processes: Piggybacking on each other’s work

requires a degree of alignment, though —

alignment in the data used in both operations

and corporate, and alignment between short-

and long-term projections.

By keeping it simple, focusing on the es-

sentials — content first, numbers second —

this entire process will reduce the time FP&A

folks spend on preparing reports.

Focusing on (creating) commonalities,

while still dealing with exceptions, sig-

nificantly reduces the complexity to some-

thing far simpler without losing important

elements, thus providing management

with timely and targeted analysis for their

decision-making. And is this not what FP&A

is all about?

C

DESPITE BEING SEPARATE FUNCTIONS, FP&A CAN PIGGYBACK ON

ACCOUNTING PROCESSES AND SHARE THE SAME SYSTEMS.

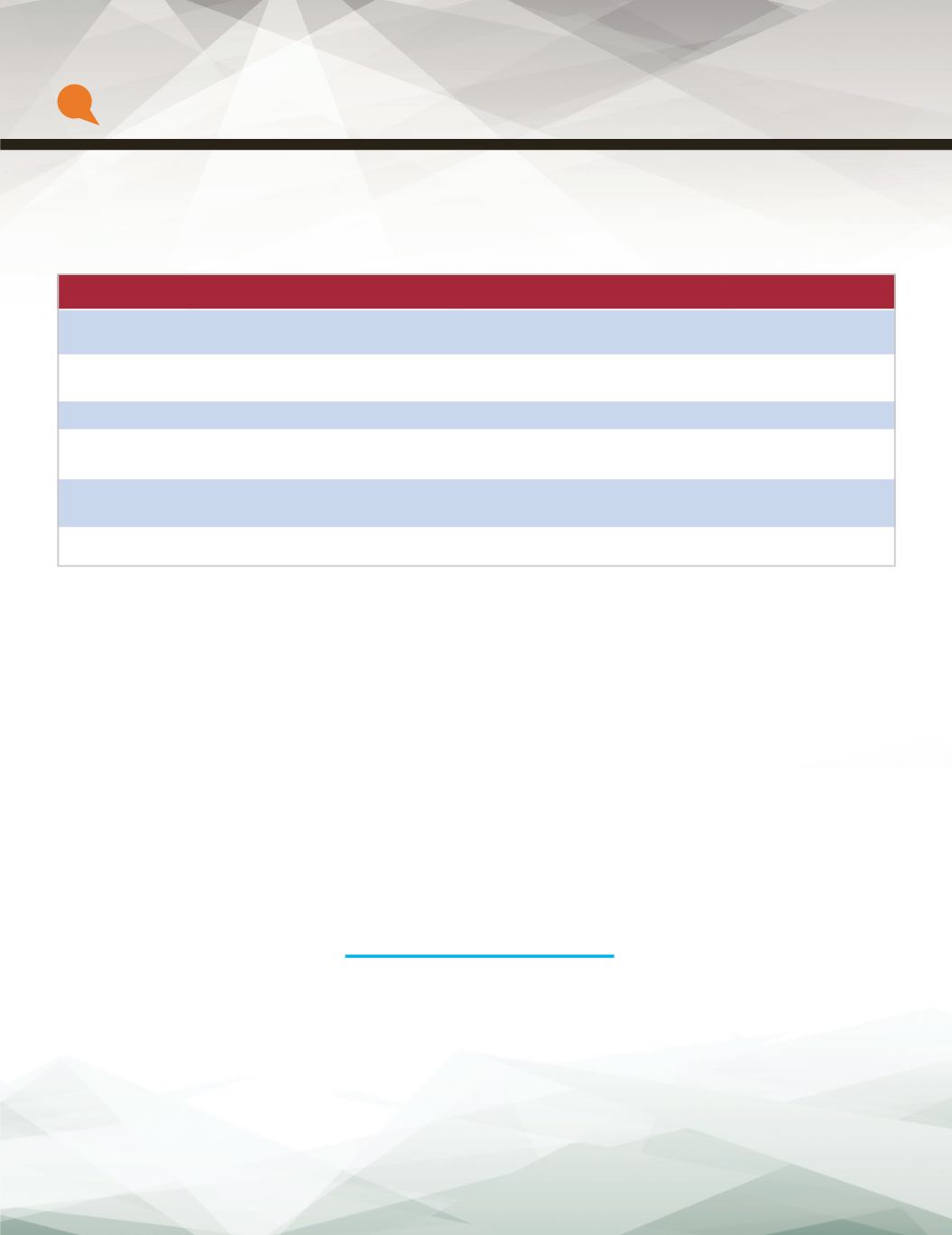

CENTRALIZED

SHARED SERVICES

DECENTRALIZED

Reporting

Reporting to external parties,

centralized functions

Repetitive reporting and analysis

Ad-hoc reporting

Analysis

Repetitive analysis (e.g. account

analysis)

Business-focused

analysis

Planning

Medium- and long-term

Short-term

FP&A Process

and System Setup, project management

Maintenance

Usage

Data Collection External (competition, market, etc.)

Internal (consolidation)

Transfer from operating systems to

FP&A systems

Data entry

Support

Strategic support

M&A support modeling

?